A new economic index sponsored by the Rockefeller Foundation finds more Americans were economically insecure at the start of the recession than in 1985.

Created by Dr. Jacob Hacker of Yale, the Economic Security Index measures "the share of Americans who experience at least a 25 percent drop in their available family income whether due to a decline in income or a spike in medical spending or a combination of the two, and who lack an adequate financial safety net to catch them when they fall." Hacker built the ESI using data mainly from the Census Bureau's Survey of Income and Program Participation.

Family wealth, household income, health care expenditures and unemployment rate are among the indicators tracked by the State of the USA. The Rockefeller Foundation is a State of the USA funder.

Here are the findings and conclusions of Hacker and his research team, via the study, "Economic Security at Risk."

- Economic insecurity has increased over the last quarter century. In 1985, 12.2 percent of Americans experienced a major economic loss sufficient to classify them as insecure in the ESI. During the recession of the early 2000s, this had risen to 17 percent. In 2007, before the current downturn, the picture had improved (13.7 percent), but measured insecurity remained higher than in the 1980s.

- Economic insecurity is likely to have increased dramatically in the last few years, according to the study's authors. Because the economic downturn after 2007 was substantial, the researchers project the ESI forward based on the 1985-2007 experience. These projections suggest that in 2009, the level of economic insecurity experienced by Americans was greater than at any time over the past quarter century, with approximately one in five Americans (20.4 percent) experiencing a decline in available household income of 25 percent or more. This projection is consistent with the findings from a separate poll of Americans' economic experiences conducted in conjunction with the development of the ESI.

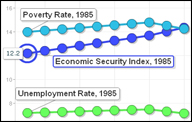

Use the motion chart below to compare the ESI, the unemployment rate and the poverty rate over time.

Please note that only data points for 1985, 1992, 2002 and 2007 were featured in Table 1 of the ESI study. The motion chart generated estimated values for each of the gap years to draw the trend line. The ESI study used Bureau of Labor Statistics data for the annual unemployment rate and U.S. Census Bureau data from the Current Population Survey (ASEC) for the annual poverty rate. Read the technical report (PDF) to learn more about the components of the ESI.

Economic Insecurity and Unemployment

- The ESI rises and falls with the state of the economy, and especially the unemployment rate. But at any given unemployment rate, more people are experiencing insecurity than in the past. In other words, the ESI has been higher relative to the unemployment rate in recent years than it was in the 1980s. In 1985, the unemployment rate was 7.2 percent, and the ESI was 12 percent. In 2002, the unemployment rate was 5.8 percent, but the ESI rose to 17 percent. Moreover, for those who experience drops in available income of 25 percent or greater, the size of drops has increased. Between 1985 and 1995, the typical (median) drop among those experiencing a 25 percent or greater available income loss was about 38.2 percent; between 1997 and 2007, it was 41.4 percent.

46 Million Americans Economically Insecure

- To see beyond short-term economic fluctuations, researchers statistically calculated the longer term trend in the ESI. Based on this analysis, the ESI has increased by approximately a third from 1985 to 2007. If the projections to 2009 are included, the ESI increased by almost half (49.9 percent) since 1985. Putting this trend in terms of population, approximately 46 million Americans were counted as insecure in 2007, up from 28 million in 1985.

Drop In Income Didn't Help

- The share of Americans experiencing large drops in available household income has increased even more since the 1960s. Because the ESI takes 1985 as its point of departure, how researchers interpreted the trend over the past quarter century depends in part on whether the mid-1980s were relatively secure or insecure for Americans. The less complete form of the ESI available back to the late 1960s shows that large (25 percent or greater) income losses--the core component of the complete ESI--had already risen by about a third from the 1960s to the 1980s, making subsequent increases over the past quarter century even more noteworthy.

Who Was Hit the Hardest

- The extent of economic security varies substantially across the population. Those with the most income and education have faced the least insecurity. The less affluent, those with limited education, African-Americans, and Hispanics have faced the most. Virtually all groups, however, experienced significant increases in insecurity over the past 25 years.

Possible Reasons for Increases in the ESI

- First, the earnings of male workers have become more unstable since the 1970s, and because men still contribute more to household income on average than do women, growing variability of male earnings has a major effect on overall household income stability.

- Second, transfer income--cash benefits received by families from government programs-- appears to have become more unstable since the 1970s.

- Third, the rising prevalence of two-earner couples does not appear to have provided a big income cushion to families. This may reflect the fact that income gains for the middle class have been relatively muted over the period studied so that families are working harder for only modestly more income while facing large price increases for health care.

ESI Study Limitations

The study also features preliminary projections for the ESI up to 2009 that can't be verified until additional data is available. Separately, the ESI researchers acknowledge some other limitations. First, it did not measure families at risk of dropping into financial insecurity, including retiring without enough money. It also does not account for other possible expenses beyond medical, such as child care costs.

(Economic Security at Risk: Findings From the Economic Security Index)

Suzette Lohmeyer is a staff writer and producer for State of the USA.

Data visualization by Anthony Calabrese, a State of the USA Web producer.